Banking on the Cloud: The Role of Cloud Computing in Modern Financial Services

Introduction

Cloud computing has completely transformed several industries, notably banking and finance. On-demand availability of computer resources, including storage, servers, databases, networking, applications, and analytics, is made possible by the internet. This makes data easily accessible to financial firms, removing the necessity for direct control over the underlying framework.

These firms no longer need to rely on traditional hard drives or storage devices as they can now store data on cloud platforms and retrieve it effectively. Cloud computing is turning into an essential instrument for digital transformation as a result of the growing complexity of banking transactions and regulatory limitations.

Businesses in finance might boost operational efficiency, stay flexible, and adhere to regulations through the use of cloud-based solutions which is continually expanding as technology advances, and standard banking and investment operations change.

This blog explores the impact that cloud computing has had and can further have on financial services, highlighting the advantages, challenges, and potential of this integration. Financial experts, IT developers and stakeholders, and company executives who want to know more about how cloud computing may improve customer satisfaction, security, and operational efficiency in the financial industry will benefit from the information that follows.

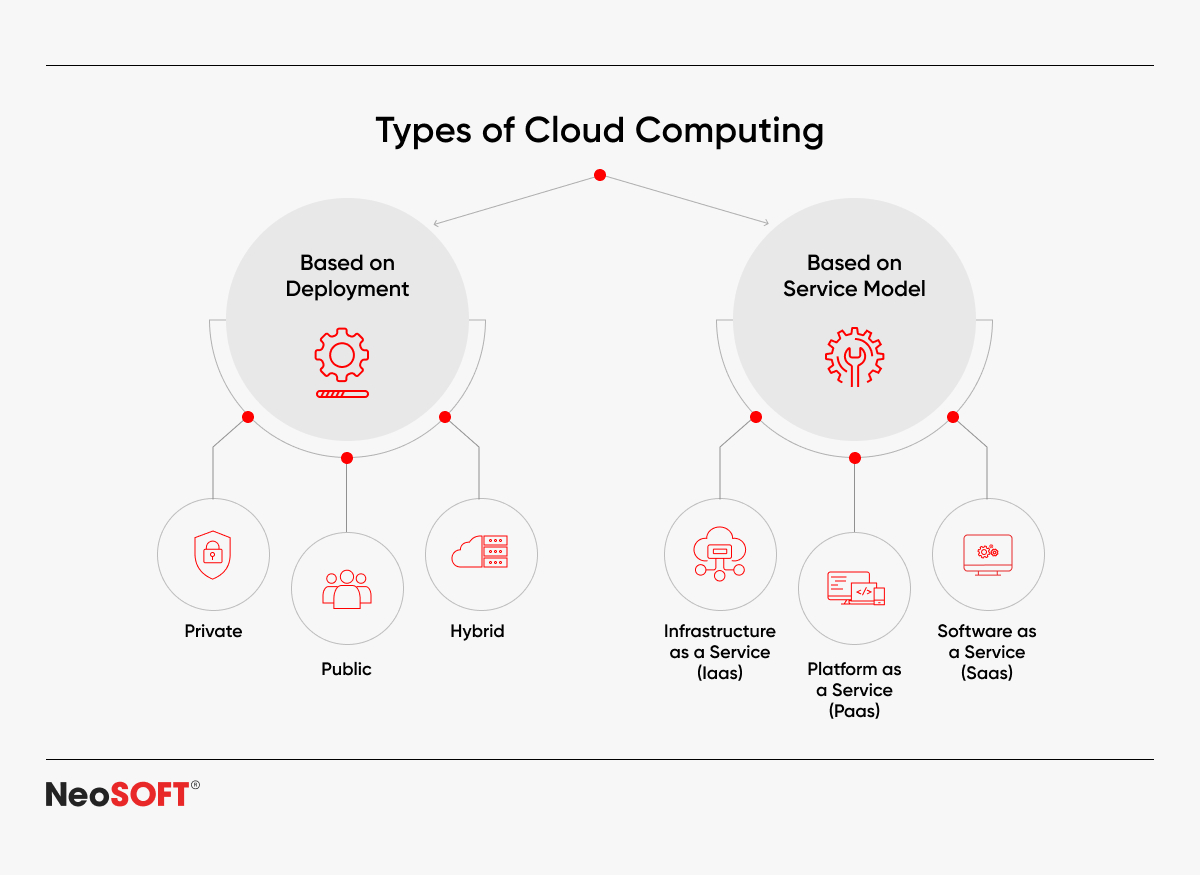

Types of Cloud Computing

Cloud computing can be divided into different types based on deployment models and services offered.

Deployment Models

- Public Cloud: Independent businesses offer public cloud services online that provide reliable resources on a subscription basis. Banking organizations use public clouds to boost efficiency, expand movement, and save expenses without having to maintain their own internal systems.

- Private Cloud: Enhanced security and control over an individual company can be made possible by a private cloud. It is a good fit for financial institutions that handle sensitive data often since the system ensures data security and regulatory compliance, even though it requires more resources.

- Hybrid Cloud: This type of cloud computing, as the name suggests, combines private and public clouds, enabling businesses to save costs and enhance security by allocating workloads based on demand.

Cloud Service Models

- Software as a Service (SaaS): Financial organizations can make use of cloud-hosted apps, such as customer relationship management (CRM) software, without having to manually install them, thanks to SaaS solutions.

- Infrastructure as a Service (IaaS): Storage and networking are instances of the standardized computing capacities that IaaS supplies. Financial institutions can use it to create scalable infrastructure without spending money on actual hardware.

- Platform as a Service (PaaS): PaaS offers platforms and development systems that let lenders design and implement applications.

The Finance Industry’s Increasing Need for Cloud Computing

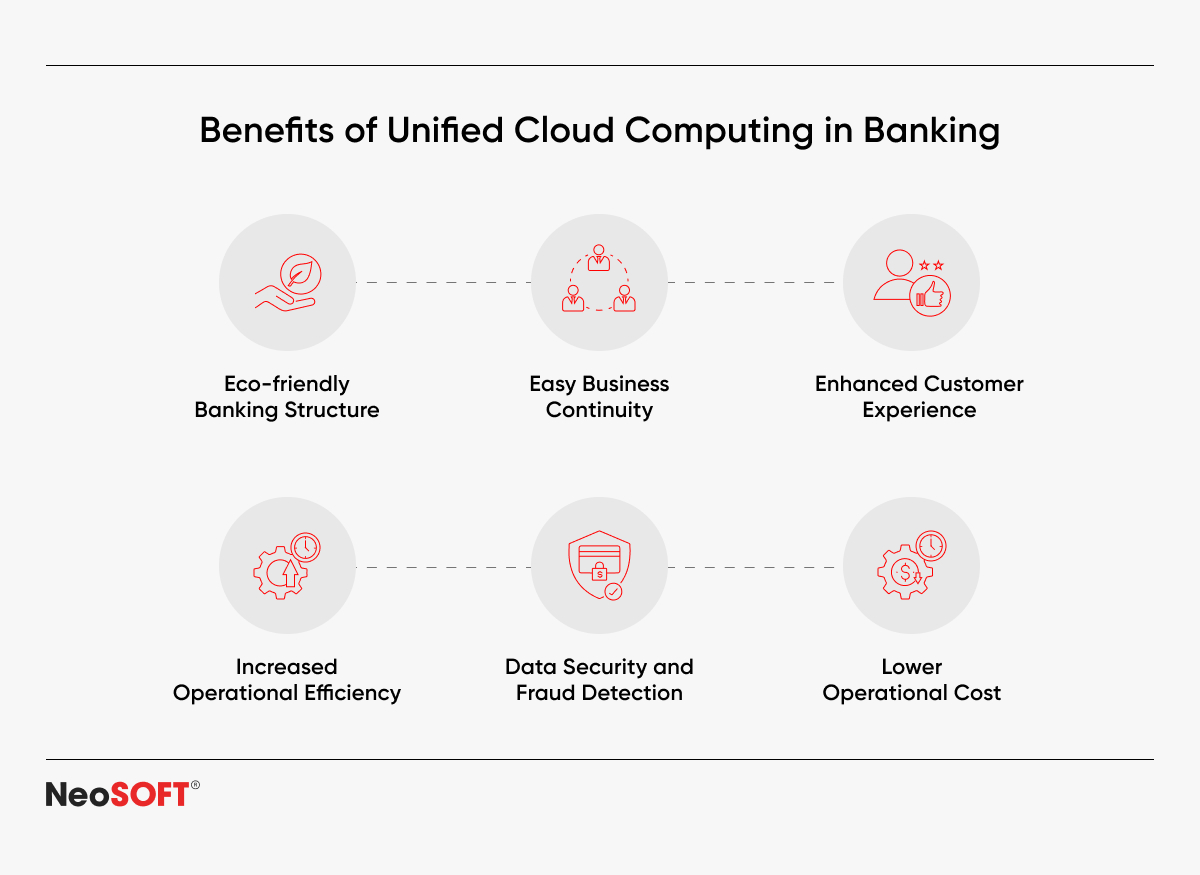

Data generation in the finance industry is growing at an unprecedented rate due to online banking, digital transactions, regulatory obligations, and client interactions. Financial institutions need adaptable, scalable solutions that can adjust to changing business needs, in order to handle this ever increasing amount of data. Large volumes of organized and unstructured data can be handled effectively using cloud computing, which also optimizes infrastructure expenses.

By ensuring smooth backup and disaster recovery options, cloud computing promotes company continuity. Conventional on-premise infrastructures are susceptible to system crashes, cyberattacks, and hardware malfunctions. Cloud-based systems, on the other hand, offer high-availability, robust environments that reduce downtime, optimize operations, and safeguard vital financial functions.

In addition to the above, cloud computing also provides fraud detection, risk reduction, and real-time analytics. Financial institutions use cloud-based artificial intelligence and machine learning tools to identify irregularities, spot fraud, and make more accurate data-driven strategic choices. Real-time data processing enables organizations to improve risk management and security, guarantee legal compliance, and proactively address new dangers in a changing digital environment.

Cloud-enabled solutions that increase agility, security, and adherence to industry standards contribute to enhanced customer service and business resilience. Financial institutions are increasingly using cloud services to automate procedures, optimize operations, and offer personalized banking experiences. Cloud computing is changing how financial services engage with their customers, whether it is through data-driven insights, mobile banking apps, or AI-driven customer service.

As more companies see the limitations of their antiquated IT infrastructure, the demand for cloud-based services will only grow. The shift to digital-first banking, increased regulatory scrutiny, and growing cybersecurity concerns make cloud adoption a strategic need for financial institutions hoping to remain competitive in an environment that has become increasingly digital.

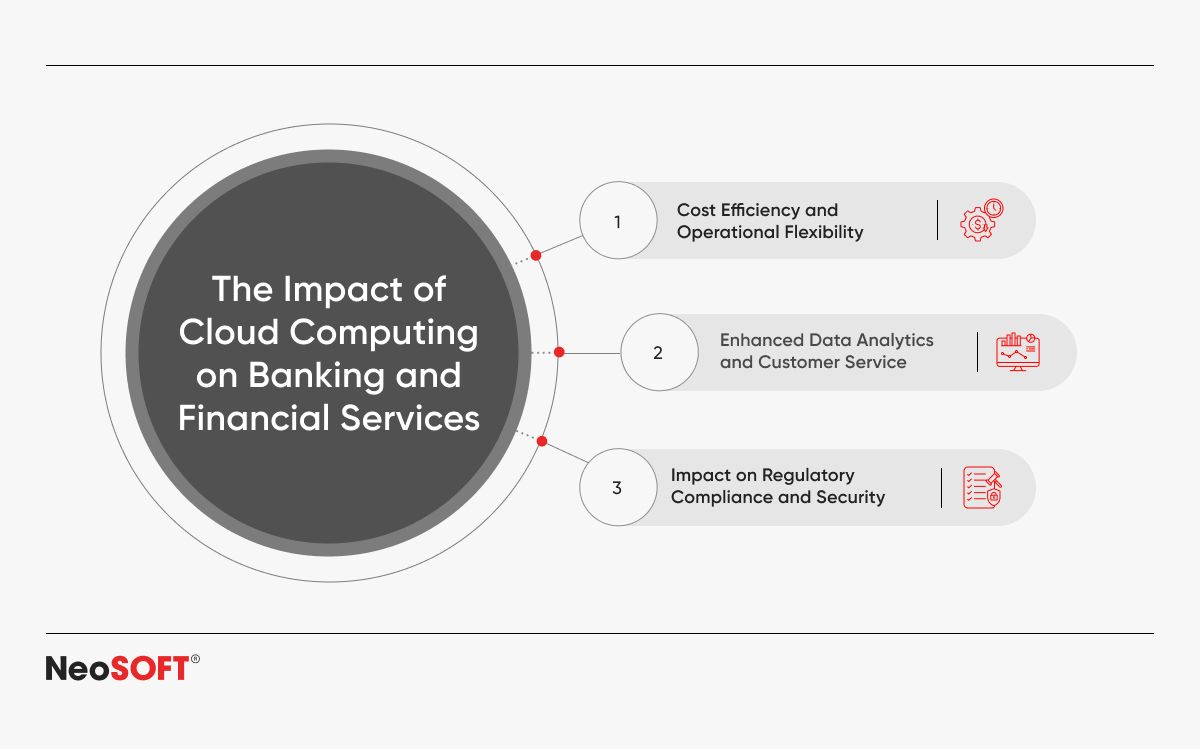

Key Benefits of Cloud Computing in Financial Services

Advancing Big Data Analytics

Financial businesses can gain insights from large datasets employing cloud-powered statistical analytics, which enhances risk estimation, identification of fraud, and strategic planning. Financial companies may improve risk mitigation procedures, refine investment strategies, and make better decisions by processing massive amounts of data in real-time. Actionable insights are offered by AI-powered analytics solutions, which assist companies in anticipating consumer demands and industry trends.

Cost Reduction and Operational Efficiency

Financial companies minimize IT infrastructure servicing costs by switching from capital to operational expenditures. Processes are simplified via cloud-based automation, improving profitability as well as efficiency. When on-premise hardware service costs drop and resources are allocated effectively, IT management’s financial risks are reduced and profitability increases. Savings can be reinvested by banking institutions in strategic projects, innovation, and improved client service.

Driving Innovation in Financial Services

Cloud computing accelerates the development of fintech solutions, allowing institutions to introduce innovative products rapidly. This fosters competition and enhances financial offerings. Cloud-powered development environments enable financial services firms to experiment with emerging technologies, ensuring a faster go-to-market strategy for innovative financial products and services. By leveraging cloud-based APIs and AI-driven applications, banks and investment firms can continuously innovate, staying ahead of industry trends.

Enhancing Data Security and Compliance

Cloud platforms protect financial data by implementing multi-factor authentication, encryption, and real-time monitoring. Automated compliance systems ensure that industry rules are followed, safeguarding consumer data and eliminating online dangers. Financial institutions must put strong security measures in place which enable use of cloud-based security features like advanced threat assessment and zero-trust technology as cyber threats continue to evolve. AI-driven monitoring and regular security updates strengthen security even more, reducing the possibility of theft along with information breaches.

Ensuring Business Continuity and Disaster Recovery

Backup and recovery features offered by cloud solutions reduce downtime and provide operational resiliency. Disaster recovery can be accelerated with centralized data storage. In the event of unplanned failures or cyber events, financial institutions can minimize interruption by replicating vital data across different locations using cloud-based disaster recovery solutions. Even in the event of unanticipated setbacks, operational continuity is guaranteed by these preemptive steps.

Facilitating Remote Work and Collaboration

Cloud technology facilitates secure remote access, which empowers finance teams to work together. Even in instances of worldwide disruptions, virtualized resources assure profitability and continuity. Cloud solutions provide financial organizations with safe online desktops and communication capabilities as remote work becomes more common, guaranteeing seamless overseas interaction. The effectiveness of workflow is increased since employees can access the data and applications they need securely and from anywhere.

Improving Customer Experience

Personalized financial services are rendered feasible by cloud-based analytics that provide insights into consumer behaviour. AI-driven recommendations, faster transactions, and greater accessibility all improve client engagement and happiness. Finance companies can offer round-the-clock support to clients by using cloud-based chatbots and AI-driven assistants, promptly answering questions and enhancing overall client engagement. Customers enjoy using services on multiple gadgets, at any time, and from any location, thanks to these innovations, which provide a smooth banking experience.

Scalability and Flexibility

Financial organizations may optimize infrastructure and expenses by scaling operations to cater to demand thanks to cloud computing. This capacity for change provides easy adaptation to shifting customer needs and market swings. Financial companies can use cloud solutions to extend their services internationally while meeting local regulatory standards and preserving a high standard of quality. Businesses can maintain their agility by modifying their resources as necessary to manage periods of high transaction volume without sacrificing performance, thanks to this dynamic scalability.

Strengthening Risk Management and Compliance

Financial institutions’ risk management skills are improved by automated compliance technologies and real-time monitoring, which guarantee regulatory compliance while reducing vulnerabilities. Financial companies may stay informed of changing legislation with the use of cloud-based compliance management tools, which lowers legal and compliance risks, and associated fines. AI-powered regulatory technology reduces operational complexity while ensuring that companies remain compliant.

Cloud Service Providers in Financial Services

In order for financial firms to fully utilize cloud computing, choosing the right cloud providers is essential. Cloud providers manage the platforms, software, and infrastructure required to conduct safe and effective financial activities. Some of the leading cloud providers include:

- Alibaba Cloud – Particularly popular in Asia, Alibaba offers scalable cloud solutions with an emphasis on security and cost efficiency. Its services include AI, big data, and security tools that support the growth of financial institutions in the region.

- Amazon Web Services – AWS provides users a comprehensive suite of cloud-based solutions, including computing power, storage, databases, and analytics, making it one of the most widely used platforms in the financial sector. The scalability, flexibility, and security features make it a preferred choice for global financial institutions.

- Google Cloud Platform – GCP provides cutting-edge data analytics, machine learning, and AI tools that are beneficial for financial services. With a strong focus on security, Google Cloud helps financial firms process large volumes of transactions and maintain compliance with industry regulations.

- IBM Cloud – Offering advanced AI, blockchain, and data analytics solutions, IBM Cloud caters to the unique needs of financial institutions. It emphasizes security, and the private and hybrid cloud options are appealing to those organizations that require high levels of control and compliance.

- Microsoft Azure – The hybrid cloud capabilities of Azure are especially valuable for financial organizations that need to manage sensitive data while also meeting regulatory compliance standards. It offers a wide array of services, including AI/ML, analytics, and blockchain, which help streamline operations in the finance industry.

- Oracle Cloud – A cloud provider renowned for its robust database management solutions, which are essential for financial services. With its suite of cloud applications, Oracle helps financial institutions streamline operations, manage risk, and enhance customer satisfaction.

These cloud providers are crucial to the continuous digital transformation of the banking and insurance sector because they allow financial organizations to innovate, expand their operations, and adhere to regulatory norms.

The Future of Financial Services in the Cloud

Through the provision of digital banking to marginalized communities, cloud-based solutions are facilitating greater access to financial resources and enhancing financial inclusion. Through the reduction of financial services entry barriers, cloud technology makes it possible for people in remote and underdeveloped regions to engage in the digital economy.

By using cloud-based mobile banking apps, financial institutions may reach a wider audience and offer underbanked and unbanked communities safe and affordable banking options. Accessibility is further improved by cloud-driven financial innovations including blockchain-based transactions, digital wallets, and microfinance programs. These technologies bridge the gap between traditional banking and contemporary digital financial services by providing people with financial tools.

Conclusion

With unmatched security, efficiency, and scalability, cloud computing has rapidly transformed the financial services sector. Cloud computing’s influence on the financial industry’s future is further cemented by the rapid growth of digital banking, AI-powered analytics, and remote accessibility. A financial business can elevate customer experiences, streamline operations, and stay compliant with regulations by adopting cloud-based technologies.

Realizing the full potential and availing of the many benefits of cloud computing to stay ahead of the digital curve calls for financial services companies to implement bespoke cloud strategies that correspond with their objectives. We can support you in bringing about your digital transformation. Reach out to us info@neosofttech.com to leverage our expert teams and integrate state-of-the-art cloud solutions for your financial services.