AI Over Instinct: How Emotion-Free Investing is Reshaping Wealth Management

April 24, 2025

Introduction

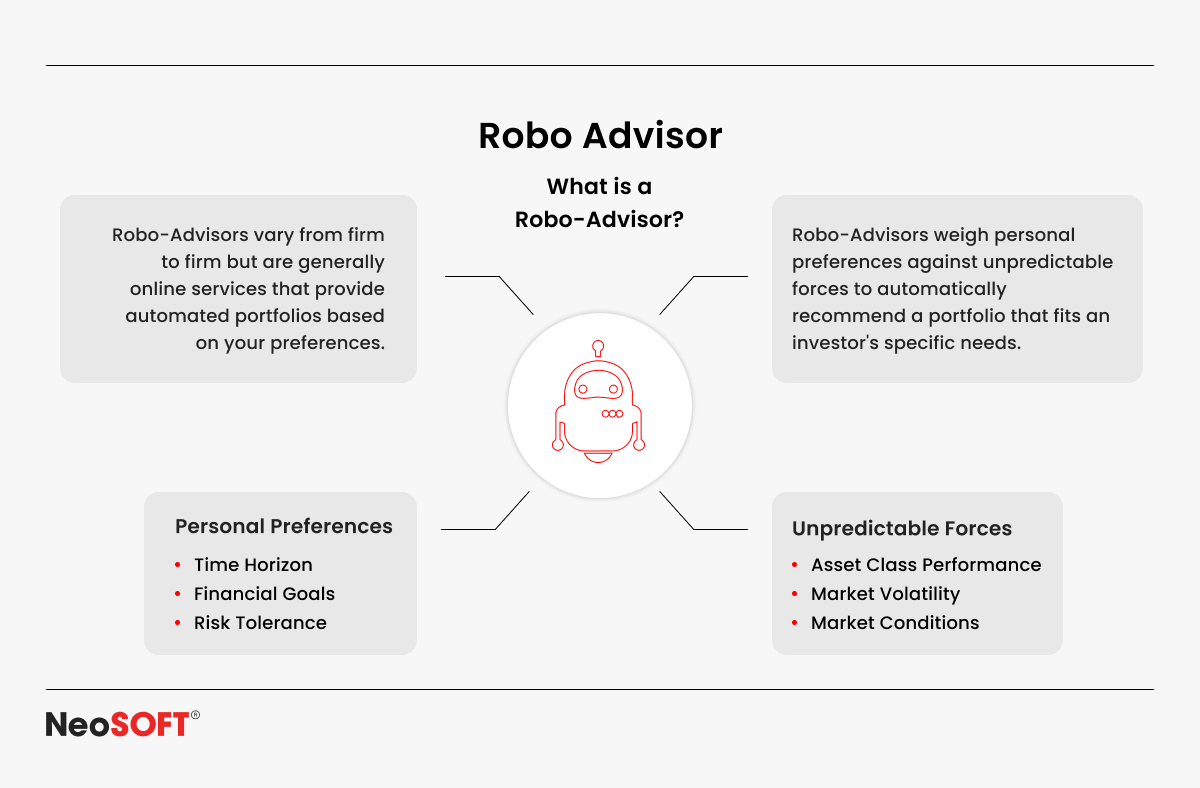

Over $1 trillion assets are being handled globally by robo-advisor firms, demonstrating the rapidly increasing significance of AI in wealth management. With no human interaction, these automated systems offer algorithm-driven financial services by creating and managing investment portfolios that match personal risk tolerance and financial objectives, such as mutual funds, index funds, and exchange-traded funds (ETFs).

The foundation of wealth management for many years has been human financial advisors, who deliver individualized investment plans based on client relationships and market knowledge. While this traditional strategy has been successful in many instances, it has frequently suffered from expensive management fees, restricted accessibility, and the inevitable impact of subjective biases, which can result in emotionally motivated and less-than-ideal investment choices.

On the other hand, robo-advisors driven by AI are rapidly transforming the investing environment. These tools empower investors in avoiding rash transactions and illogical financial decisions by doing away with emotional decision-making and depending only on data-driven insights. By providing intelligent, automated investing methods with fewer capital requirements, they have also liberalized access to financial advice, enabling younger and novice investors to more easily access wealth management services.

As financial markets are becoming more complex, AI-powered investing solutions are growing in number offering a scalable, reasonably priced, and effective substitute.

This blog will examine the ways that wealth management is changing because of AI and emotionless investing. Predictive analytics and machine learning’s role in portfolio management, the advantages and drawbacks of AI-powered investing tools, and the future of financial advising services in a digital-first economy will all be covered. This blog will provide details about the developing field of AI-driven wealth management, regardless of your background as a retail investor, financial advisor, or fintech enthusiast.

Types of Robo-Advisors

Fully Automated Robo-Advisors

These solutions powered by AI manage all facets of investment management without the need for human oversight, from rebalancing to portfolio construction. They assess risk tolerance, allocate assets, and optimize investments based on market trends.

Hybrid Robo-Advisors

AI-driven portfolios with professional consultation for individualized recommendations are offered by hybrid robo-advisors, which combine AI and human knowledge. Investors that respect human insights but also desire automation may find this model appealing.

For instance, the Vanguard Digital Advisor combines expert financial advice with quantitative accuracy to provide a comprehensive approach to financial planning. As consumers seek actively managed funds, hybrid robo-advisors offer a blend of human insights and AI-driven asset management to optimize mutual fund selection.

Niche Robo-Advisors

These specific platforms focus on certain financial subjects, such as cryptocurrency portfolios, alternative asset classes, or ESG investing, which is perfect for investors with specific investment goals or ethical standards.

Technologies Behind Robo-Advisors

Robo-advisors apply modern technology to automate trading strategies, optimize portfolios, and carry out transactions quickly.

Artificial Intelligence & Machine Learning

AI and ML can spot trends and make wise investment strategies, through processing enormous amounts of financial data, these models continuously enhance asset allocation and risk assessment. A 40% improvement in software development productivity has been recorded by banks using AI for decision-making, stated McKinsey, demonstrating the enormous scope of AI to automate financial operations and improve wealth management.

Big Data Analytics

Stock market trend analysis, portfolio augmentation, and risk profiling are all made easier by big data. Robo-advisors gather financial records, stock fund data, and macroeconomic factors to provide personalized value investing advice.

Furthermore, by integrating predictive analytics, robo-advisors are able to precisely forecast shifts in markets and decrease risks. Accenture estimates that the initial users of generative AI might experience a 600 basis point boost in revenue growth and productivity gains of 22% to 30%. It is used by platforms like Vanguard Digital Advisor, to tailor index funds and ETF according to each user’s financial objectives and risk tolerance.

Algorithmic Trading

Algorithmic trading allows robo-advisors to swiftly complete trades using pre-programmed tactics for cost-effectiveness, accuracy, and promptness. Automated portfolio rebalancing lowers transaction costs and optimizes earnings by maintaining the optimal asset mix and adjusting holdings in response to changing market circumstances.

Key Advantages Over Traditional Capital Management

Robo-advisors have revolutionized the world of finance management by providing a data-driven, accessible, and reasonably-priced method of value investing. These AI-driven platforms, in contrast to traditional financial advisors, maximize asset management while removing human bias through automation and sophisticated algorithms.

Transparency

Robo-advisors offer more transparency by displaying investment plans, fees, and performance in a way that is straightforward. Unlike traditional advisors, whose procedures may be less transparent, investors maintain control and knowledge through user-friendly dashboards and data-driven decisions.

Cost Efficiency

Cost effectiveness is one of the primary advantages of AI investment advisors. Conventional investment advisors often demand substantial advisory fees, frequently as a percentage of assets of management (AUM). However, due to automation, robo-advisors incur less costs, making asset management accessible to a large audience.

Accessibility

AI investment advisers democratize investing by enabling even the most modestly capitalized investors to access complex financial strategies. Even people with no prior financial expertise can confidently begin investing thanks to user-friendly interfaces and automatic assistance.

Personalization

Robo-advisors may alter investing strategies to suit a person’s risk tolerance, economic objectives, and market conditions with the use of AI-driven insights. The versatility of AI-driven solutions for wealth management is illustrated by Accenture, who states that 73% of jobs completed by U.S. bank staff possess the capacity for AI-driven transformation, with 39% being appropriate for automation and 34% for augmentation.

Speed & Efficiency

Robo-advisors use AI and algorithmic trading to carry out real-time portfolio modifications, guaranteeing optimum asset allocation and risk reduction, in contrast to traditional advisors who need personal assistance and time-consuming consultations. The potential of robo-advisors to respond promptly to market changes makes them an effective substitute to standard capital management, improving the efficiency of transactions.

How to Start Investing with Robo-Advisors

Step 1: Define Your Financial Objectives

Prior to choosing a robo-advisor, ensure that your objectives are defined. Typical goals consist of:

- Wealth Growth: Robo-advisors empowered by AI find emerging companies and stocks with significant development potential.

- Retirement Planning: Tax-efficient techniques for managing retirement funds, such as Roth IRAs, IRAs, and 401(k)s are maximized by robo-advisors.

- Generating Passive Income: AI preserves portfolio balance while dividend stocks, bonds, and REITs offer predictable revenue.

- Preserving Capital & Managing Risk: Diversified portfolio, bond, and alternative asset allocations are beneficial for low-risk investors.

Step 2: Choose a Robo-Advisory

Select one based on your needs:

- Vanguard Digital Advisor – Low-cost index fund investing, ideal for retirement planning.

- Betterment – Best for ESG investing, tax efficiency, and passive asset management.

- Wealthfront – Ideal for tech-savvy investors looking for automated harvesting of tax losses.

- M1 Finance – The best option for self dependent investors seeking AI automation for portfolio management.

- Schwab Intelligent Portfolios – Great for retirees needing no advisory fees and automatic rebalancing.

Step 3: Fund Your Account & Use Dollar-Cost Averaging (DCA)

Start with investing a fixed amount at regular intervals (DCA) to:

- Reduce the impact of market fluctuations

- Avoid emotional investing

- Build wealth consistently

Example: Investing $500/month instead of $6,000 at once helps buy more shares when prices are low and fewer when high.

Step 4: Monitor & Adjust

While robo-advisors automate rebalancing, periodic reviews ensure alignment with your financial goals.

- Review annually to adjust risk levels as needed.

- Adapt to life changes like marriage, home purchase, or retirement.

- Consider a hybrid advisor if you want AI automation with human financial guidance.

Challenges and Limitations

Whilst robo-advisors have numerous benefits, investors must take into consideration the limits of these automated investment platforms, ranging from a lack of human experience to regulatory issues.

Lack of Human Expertise

The human touch and complex decision-making that qualified investment advisors offer are absent from robo-advisors, despite their efficacy.

When creating investing strategies, conventional advisors take into account personal factors such as life transitions, personal objectives, and behavioral biases.

However, because robo-advisors just use algorithms and historical data, they might not always bring complex financial conditions or emotional decision-making into account. Human advisors remain to be invaluable for investors with complex financial needs, such as pensions, tax efficiency, or estate planning.

Market Volatility Risks

The use of preset algorithms and previous data by robo-advisors could hinder their ability to adjust to novel market circumstances. Leading banks have seen increased returns on equity and overall shareholder returns as a result of implementing AI, reports McKinsey, but the company cautions that enterprise-wide change is required for long-term gains.

Moreover, robo-advisors respond exclusively to data trends, which may lead to inadequate investment strategies during market turbulence, in lieu of human advisors who offer judgment and foresight.

Over-Reliance on Algorithms

The efficiency of robo-advisors is determined by the complexity of the algorithms they use. Incorrect, biased, or obsolete algorithms can lead to adverse investment strategies and monetary losses.

In addition, automated systems can sometimes be able to anticipate sudden shifts in investor behavior, regulations, or macroeconomic situations. Even though AI models constantly acquire knowledge from data, they are not immune to biases or mistakes that can come from prior patterns.

Regulatory and Security Concerns

Robo-advisors have to conform to strict rules since they handle sensitive financial data. Regulations are still being modified by governments and financial organizations to guarantee adherence, openness, and moral AI implementation in capital management.

Furthermore, since robo-advisors rely upon digital platforms, they are vulnerable to hacking attempts, thus facing a threat towards cybersecurity. Strong data protection policies are required for maintaining investor confidence and preserving funds from malicious activity.

Limited Customization for Unique Financial Goals

Robo-advisors are adept at general financial strategies, nevertheless they might not be able to accommodate specialized investing preferences that include highly customized wealth-building initiatives or alternative assets. Traditional advisors may be more beneficial for people with particular financial needs.

Even If robo-advisors are efficient and readily available, their disadvantages show how important it is to strike an equilibrium between automation and financial knowledge. Resolving these issues will be crucial for the ongoing success of AI technology as it progresses.

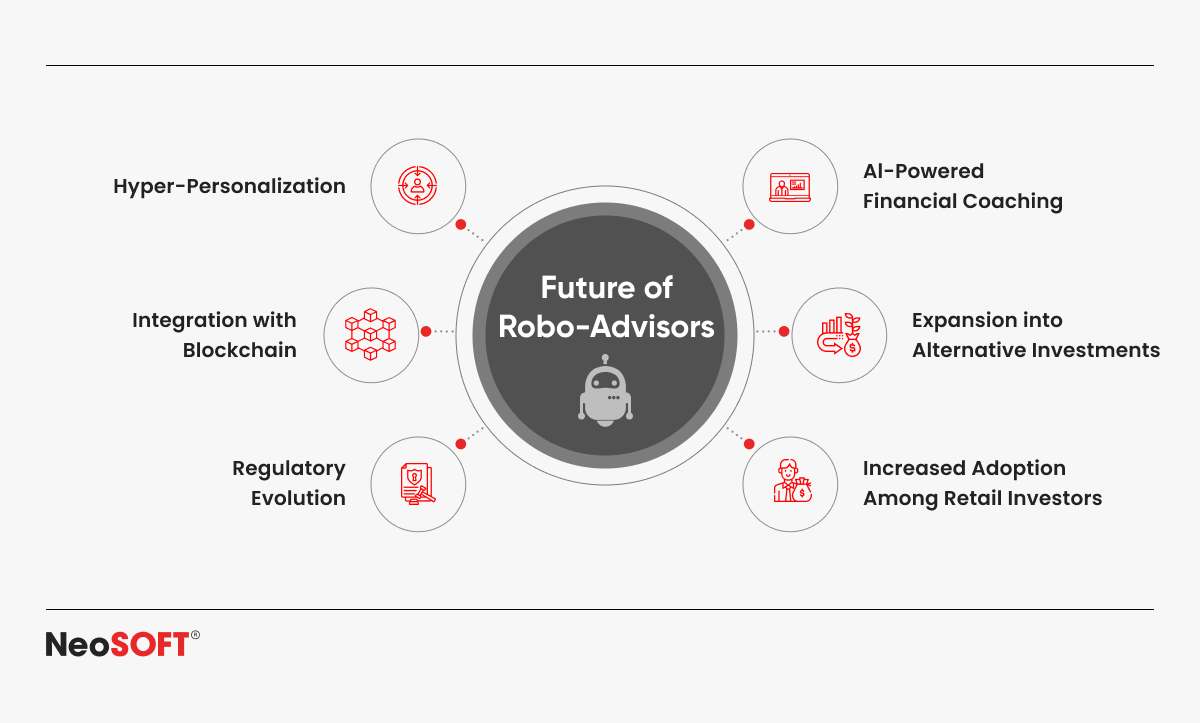

Future of AI-Driven Asset Management

The global landscape of financial allocation is altering as robo-advisors continue to develop in tandem with technological advancements. In order to increase their sophistication and dependability, robo-advisors are incorporating human knowledge, cutting-edge AI abilities, and regulatory frameworks.

Hybrid Models: The Best of Both Worlds

A combination of robo-advisors and human advisors to finance management is probably in store for the future, with algorithms powered by AI managing data-driven allocation optimization and human specialists offering tailored financial advice for intricate investment choices.

This method assures that the investors gain from automated efficiency while maintaining accessibility to professional insights, particularly related to high-net-worth investment strategies, retirement planning, and estate management. In order to handle both index funds and active funds and provide tailored investing solutions, future hybrid models may combine AI-driven procedures with professional insights.

Advancements in AI Algorithms: Smarter and More Adaptive Investing

Robo-advisors might enhance market predictions, optimize risk management, and hone investment strategies thanks to the ongoing advancements in AI and machine learning algorithms. More flexible artificially intelligent machines that can assess market circumstances in real time, recognize new trends, and respond quickly to shifts in the economy will result from future developments. Based on a report by Accenture, banks that adopt an organized AI transformation approach may experience a surge in return on equity of up to 300 basis points over the following three years.

With these enhancements, robo-advisors will be able to manage financial risks and offer more accurate suggestions for investments, which will lower the possibility of losses during times of market volatility. Furthermore, robo-advisors will be able to assess investor behavior using AI-driven sentiment research, guaranteeing a more individualized and calculated technique for asset management.

Regulatory Evolution: Strengthening Ethical AI Use

Stricter frameworks will be put in place by the banking industry and authorities to ensure the ethical and responsible use of AI in capital management as it becomes increasingly common. These rules will make sure that robo-advisors follow just and moral principles by emphasizing obligation, transparency, and investor protection.

Users will be safeguarded from unethical trading techniques, biased algorithms, and data security breaches by improved compliance rules. Furthermore, regulatory agencies will call for more disclosure and monitoring as AI becomes more prevalent in financial decision-making, guaranteeing that investors are fully aware of how AI affects their investing strategy.

Cutting-edge AI developments, evolving regulatory frameworks, and hybrid guidance models are all propelling major change in the robo-advisor field. AI-powered expenditure will become safer and more effective than before as these automated systems develop further, offering investors with increased accuracy, flexibility, and security.

Future-proofing Finance with Robo-Advisors

Investment strategies will be modified by AI-driven innovations in the coming generations of robo-advisors, which will be more diversified, personalized, and adaptive.

- Greater AI-Personalization: In the future, automated advisors will use real-time data and behavioral finance to customize investing strategies, expanding beyond static risk profiles.

- Integration with DeFi: Blockchain-based investing will enable access to tokenized assets, crypto portfolios, and smart contract-driven asset management.

- Real-Time Market Adaptability: AI will evolve from pre-set algorithms to adaptive learning models, reacting dynamically to economic shifts and financial crises.

- AI-Driven Hybrid Advisory: A deeper fusion of AI and human expertise will enhance asset management, combining automated efficiency with strategic financial planning. McKinsey highlights the need to move from isolated AI pilots to full-scale integration for cohesive AI-driven financial advisory services.

Conclusion

Future developments in wealth management are being shaped by the emergence of robo-advisors. Hybrid models are providing a compelling solution of coupled algorithmic precision and individualized financial advising by integrating human experience with AI-driven automation.

Financial authorities are creating more stringent regulations for compliance as AI deployment increases in order to guarantee algorithmic accountability, transparency, and information protection. By preserving equity in automated investing and bolstering investor confidence in AI-powered financial products, these rules will make investing more intelligent and effective.

AI-driven platforms are affecting the way individuals think about financial progress as they continually acquire information and adapt. The moment has come to adopt AI-driven investment, which uses data-driven insights and automation to create a more intelligent financial future.

Through the help of our AI-powered robo-advisory solutions, experience the potential of data-driven, bias-free investing. Get in touch with us today at info@neosofttech.com to discover how our intelligent portfolio management can assist you in achieving your financial goals.