Core Banking, Supercharged: How AI/ML Are Driving Financial Innovation

April 11, 2025

Introduction

Recent developments and innovations in machine learning (ML) and artificial intelligence (AI) are causing major transformations in the banking sector. With AI and ML facilitating automation, forecasting, and real-time decision-making, financial institutions are aiming to improve security, data management, efficiency, loan management, and customer experience.

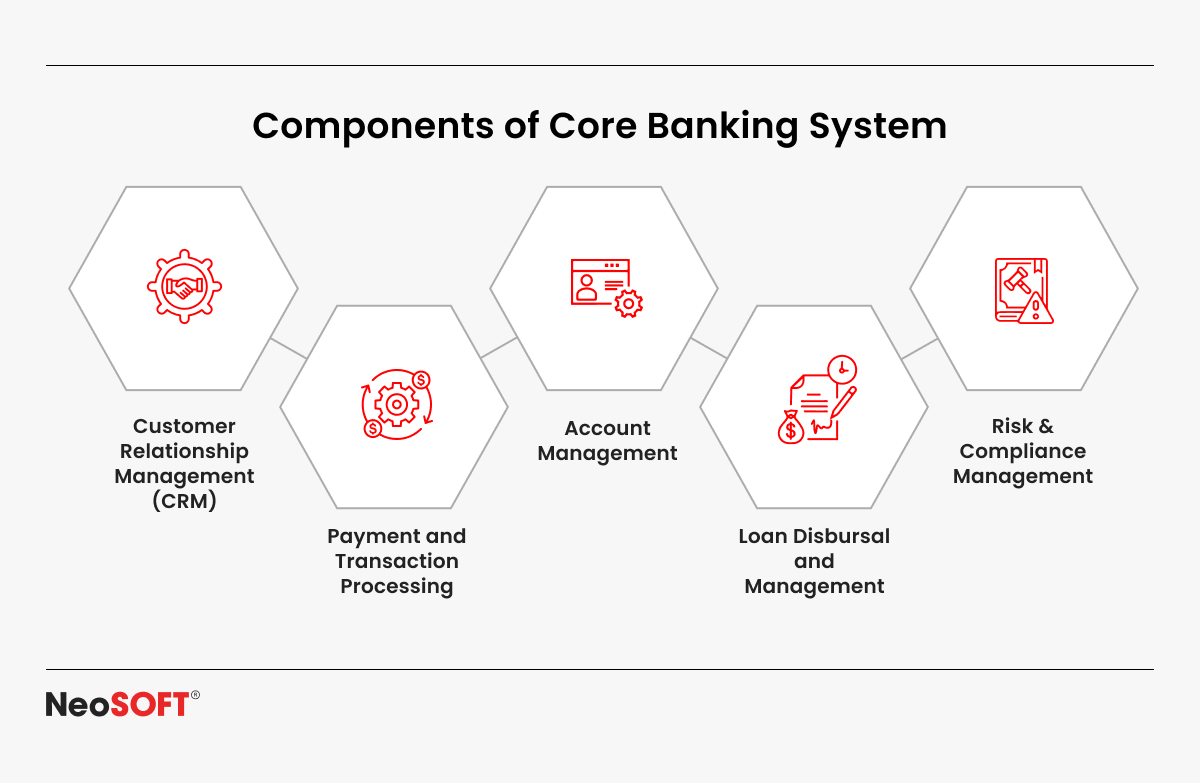

Core banking refers to the back-end system that handles daily banking activities and services such as account management, transactions, loans, and deposits. It is the cornerstone of modern banking processes, guaranteeing smooth financial transactions through digital platforms, branches, and third-party connections. Maintaining regulatory compliance and operational efficiency and giving customers an excellent client experience all depend on a strong core system of banking infrastructure.

Legacy infrastructure, sluggish processing, and growing cybersecurity concerns are common problems affecting traditional core banking systems. There has never been a greater need for highly automated, intelligent, and secure financial ecosystems. By strengthening fraud detection, improving operations, and delivering highly customized core banking applications and experiences to customers, AI and ML are working to address these issues.

In this blog, we discuss the main advantages, potential advances, and the reasons financial institutions need to adopt these technologies in modern core banking systems in order to remain effective in a world that continues to grow increasingly digital. It is intended for IT executives and decision-makers, banking professionals, and leaders in financial technology who want to learn more about how AI and ML are transforming core banking.

The Current Challenges in Core Banking Services

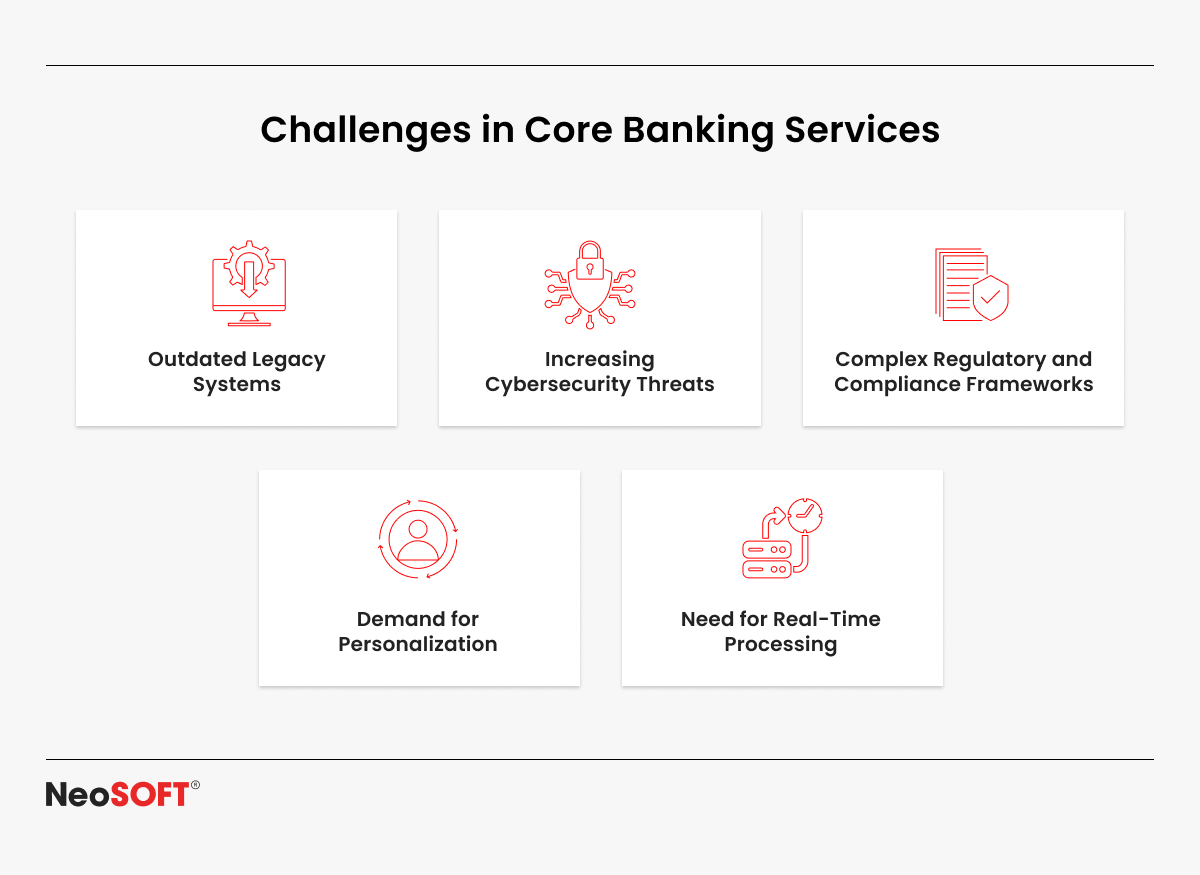

Even while financial technology is developing at a rapid pace, many banks continue to use antiquated core banking systems that are unable to keep up with the needs of the modern digital economy. Financial institutions face a number of significant issues as regulatory requirements tighten and client expectations change. These challenges include:

Outdated Legacy Systems

Many banks still use outdated, decades-old infrastructure that isn’t adaptable enough to include contemporary AI-powered solutions. Inefficiencies, increased operating expenses, and sluggish innovation are caused by these outdated systems.

Increasing Cybersecurity Threats

The growing digitization of financial services and institutions has led to an increase in the sophistication of cyber threats, including fraud, identity theft, and data breaches. Advanced security solutions are essential since standard security measures often prove insufficient to fend off AI-powered threats.

Complex Regulatory and Compliance Frameworks

Banks are required to adhere to constantly changing financial rules, including KYC (Know Your Customer) and AML (Anti-Money Laundering) policies. Risks to one’s finances and reputation arise from manual compliance procedures, which are laborious and susceptible to mistakes.

Demand for Personalization and Real-Time Processing

Consumers expect flawless, real-time banking experiences that include tailored financial advice and information. However, typical banking systems’ capacity to provide specialized services is restricted by their inability to effectively handle large volumes of transactional information.

In order to maintain their competitiveness, financial institutions must update their basic banking systems. As we shall see in the upcoming sections, AI and ML offer effective answers to these challenges by facilitating automation, improving security, and enhancing decision-making.

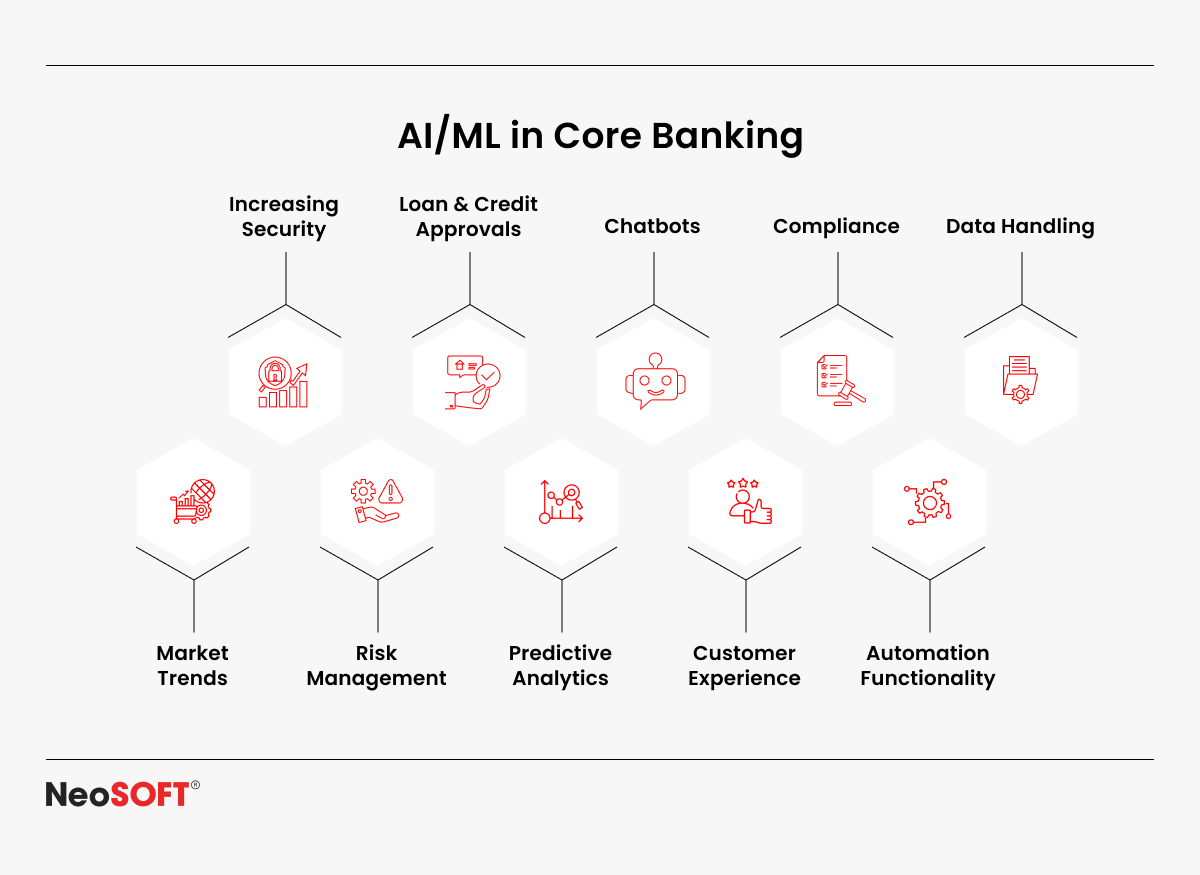

How AI and ML Are Revolutionizing Core Banking Solutions

Bank operations are being redefined by artificial intelligence (AI) and machine learning (ML), which are improving the efficiency, security, and customer-centricity of financial systems. Core banking software is becoming more intelligent than ever by utilizing artificial intelligence-driven automation, predictive analytics, and automated decision-making. Here’s how:

AI-Driven Automation for Faster Banking Services

AI-driven automation is replacing manual banking procedures like loan approvals, loan management, transaction processing, and even account creation and administration. This decreases human mistakes, speeds up procedures, and saves money. Bots powered by AI and virtual assistants also assist in expediting customer service by responding to requests and transactions around the clock.

Improved Fraud Detection for Better Security

AI and ML can evaluate massive volumes of transaction data in real-time, detecting suspicious activity and preventing fraud before it occurs. AI-powered fraud protection solutions add a layer of security by recognizing abnormal spending patterns, minimizing financial losses and increasing customer trust.

Personalization for Enhanced Customer Engagement

AI-powered analytics assist banks in analyzing client behavior and preferences, allowing for highly tailored suggestions. Banks can provide every customer with a unique experience, from individualized financial guidance to AI-powered investment analytics, thus increasing engagement and loyalty.

Risk Management and Compliance for Informed Decision Making

Financial institutions have significant challenges in ensuring regulatory compliance. AI and machine learning simplify compliance by automating Know Your Customer (KYC) as well as Anti-Money Laundering (AML) processes, minimizing errors and helping institutions stay ahead of regulatory changes. ML algorithms also improve credit risk assessment, resulting in enhanced lending decisions.

Financial institutions can thus boost their efficiency, security, and personalization by incorporating AI and ML in their core banking system.

AI’s Place in Secure and Intelligent Transactions

Fast, safe, and easy transactions are of utmost importance as digital banking expands. AI-driven innovations are improving security, preventing fraud, and simplifying daily banking transactions. Here are some ways AI is influencing safer and more intelligent financial transactions:

Biometric Authentication and Behavioral Analytics

Sensitive financial data can no longer be adequately protected by traditional password-based security. An additional degree of security for customer data is provided by AI-driven biometric authentication, which includes voice, facial, and fingerprint recognition. AI is also used in behavioral analytics to monitor user behavior, identify anomalies such as odd login locations or device modifications, and instantly indicate possible dangers.

AI-Driven Fraud Prevention and Threat Detection

AI keeps a close eye on banking transactions and uses machine learning algorithms to identify fraudulent activity. These systems have the ability to examine transaction patterns and immediately stop suspicious activities before they are completed. This proactive strategy significantly decreases the risks of identity theft, phishing, and cyber fraud.

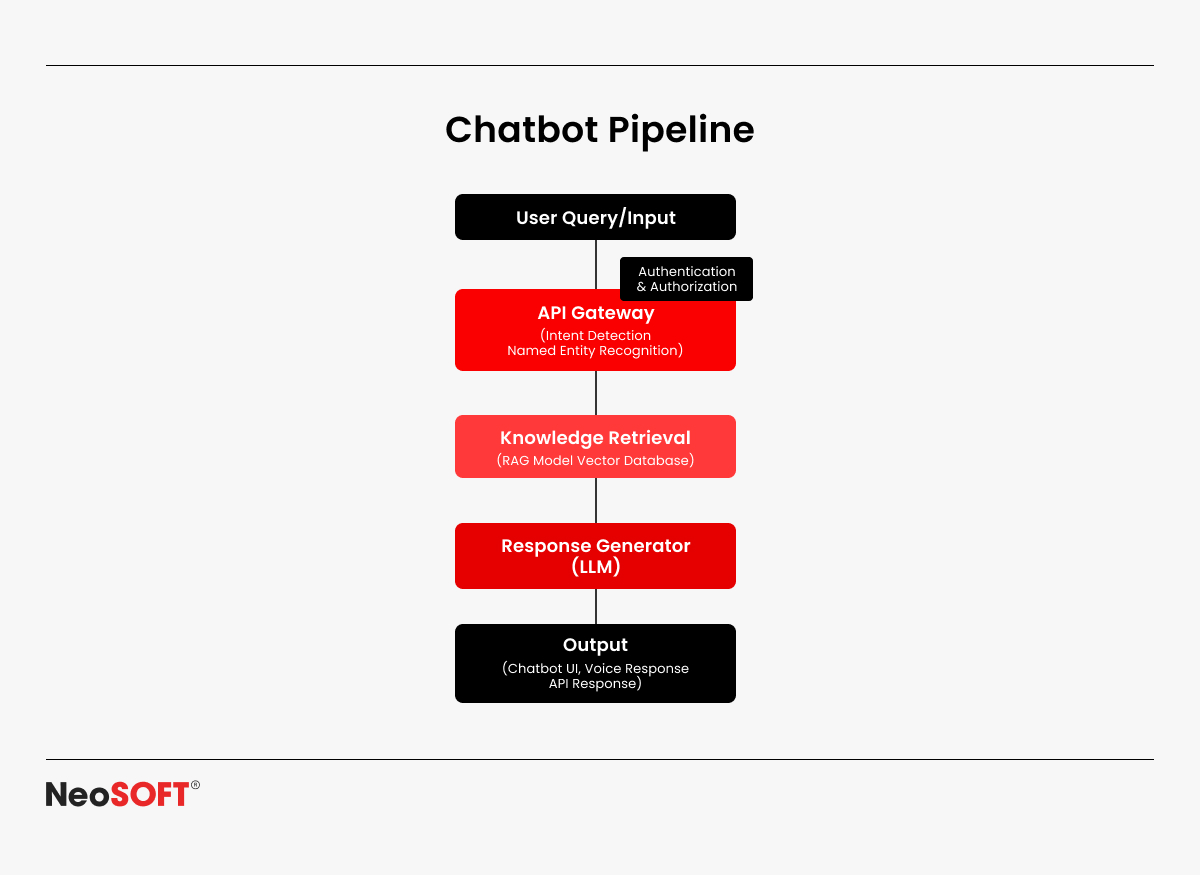

AI-Powered Chatbots and Virtual Assistants

AI-powered smart banking assistants offer real-time transaction assistance, fraud detection, and payment reminders. With the help of these virtual assistants, customers can easily manage accounts, establish spending restrictions, and schedule bill payments while navigating complicated financial procedures.

Smarter Credit Scoring and Loan Approvals

In order to generate a credit score that is more accurate, machine learning models examine a borrower’s past transactions, spending patterns, and other financial data. This benefits both banks and consumers by enabling quicker, more equitable, and data-driven credit processing and loan approvals.

Banks can boost consumer satisfaction, increase security, and expedite processes by integrating AI into financial transactions.

Future Trends in AI and ML for Core Banking

The impact of AI and ML on core banking will only increase as these technologies develop further. New applications and emerging technology have the potential to completely change the way banks function by improving client satisfaction, security, and operational efficiency. The following major themes will influence how AI and ML are used in core banking going forward:

Hyper-Personalization

Beyond simple recommendations, AI-driven hyper-personalization will provide clients with real-time guidance, product recommendations, and customized financial insights based on their particular financial behavior. This level of customization will increase loyalty and foster deeper connections with customers.

Predictive Analytics for Risk Management

Banks will be able to identify market trends and customer expectations, evaluate possible risks, and make better decisions thanks to advanced predictive models. Financial institutions will be able to detect fraud trends, proactively address credit risk, and minimize threats more accurately with the use of AI.

Blockchain and AI Integration for Enhanced Security

Blockchain and AI together will give banking systems previously unheard-of security and transparency. AI’s capacity to examine and identify irregularities in combination with blockchain’s unchangeable record will produce a safe, impenetrable environment for compliance, customer relationship management, and transactions.

Voice-Enabled Banking and Conversational AI

Conversational banking interfaces and AI-powered voice assistants will allow customers to conduct transactions, ask questions about account information, and obtain tailored financial insights using natural language. The convenience and engagement of customers will be improved by this smooth exchange.

Quantum Computing for Complex Financial Models

As quantum computing develops, it will speed up the processing of intricate financial models, giving banks the ability to manage large-scale risk assessments, optimize portfolios, and make transactions in real-time with unprecedented speed and accuracy.

What Software Development and IT Service Companies Can Do

As banks adopt AI and ML to upgrade their core systems, they need dependable technology partners to successfully integrate these advanced technologies. Software development and IT services companies are crucial to supporting this change by offering expertise, infrastructure, and support. Here’s how they can contribute:

Building AI-Powered Banking Solutions

AI-powered banking solutions can be designed and deployed by software development organizations to streamline banking procedures, improve fraud detection, and create tailored customer experiences. They ensure that AI can be effortlessly integrated into core financial systems by designing intelligent chatbots and building predictive analytics models.

Implementing Advanced Cybersecurity Measures

Banking security standards can be strengthened by IT service providers using biometric authentication and AI-powered fraud detection. They use real-time threat detection technologies and sophisticated security mechanisms to protect client information and fight cyberattacks.

Developing Scalable Cloud-Based Infrastructure

Modern financial systems need cloud-based solutions that provide data security, scalability, and adaptability. In order to facilitate the smooth integration of AI and ML features and save operating costs, IT service and cloud solutions providers help banks migrate existing systems to the cloud.

Developing APIs and Third-Party Integrations

Banks must incorporate AI solutions with third-party services and current systems to improve functionality. APIs are created and maintained by software companies to provide seamless communication between bank’s servers, payment gateways, core banking platforms, and other online platforms.

Providing Ongoing Support and Maintenance

AI-driven systems need to be continuously observed and adjusted. Long-term support from IT service providers guarantees that the AI models maintain their accuracy, compliance, and security as they change to meet changing business needs.

Financial institutions may successfully deploy AI and ML technologies by collaborating with seasoned software development and IT service providers, turning their core banking systems into intelligent, safe, and incredibly effective platforms.

Conclusion

By improving the intelligence, security, and efficiency of financial systems, AI and ML are revolutionizing core banking services. These technologies are transforming the way banks function, from automating repetitive procedures and improving fraud detection to providing individualized customer experiences and guaranteeing regulatory compliance. Financial institutions that use AI and ML will remain ahead of the curve as digital banking develops, providing their clients with creative, safe, and frictionless services.

It is crucial to collaborate with seasoned software development and IT services firms in order to successfully manage this transition. With the help of these IT partners, banks may modernize and manage their core banking infrastructure and succeed in the fiercely competitive digital market by creating, implementing, and maintaining AI-driven banking solutions.

AI-powered core banking is the way of the future; it is intelligent, safe, and designed for the next generation of financial services. Banks need to invest in these advancements now to realize their full potential. Are you ready to leverage the next-gen capabilities of AI and ML to revolutionize your core banking systems? Contact us at info@neosofttech.com to discover how we can help you develop smart, secure, and future-ready financial core banking solutions.