The Future of DeFi: How Blockchain is Transforming Financial Services

March 18, 2025

Introduction

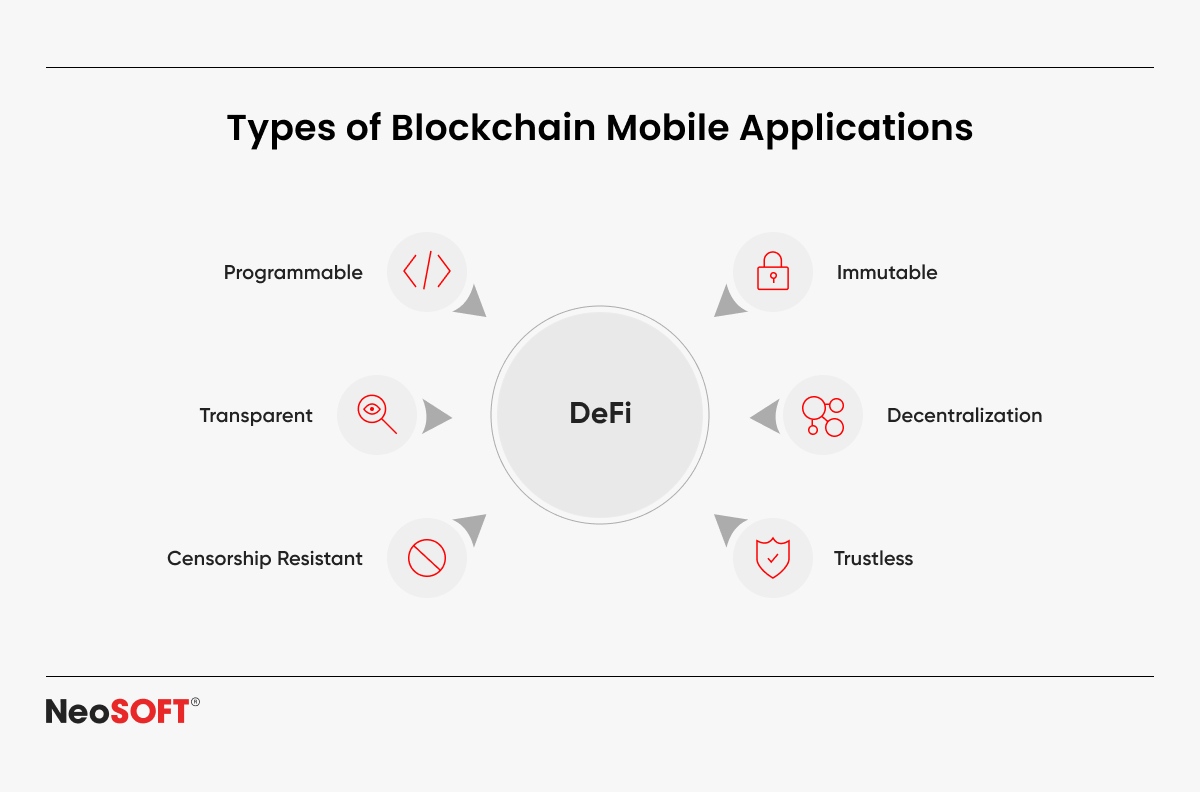

Decentralized Finance (DeFi) is redefining the financial landscape by getting rid of intermediaries such as banks and other financial institutions and allowing users to access banking services through blockchain-powered platforms. This ecosystem is based on smart contracts that enable direct peer-to-peer lending and transactions, providing transparency, security, and greater financial inclusion.

Blockchain technology serves as the foundation, ensuring tamper-proof and trustless transactions. Decentralized systems reduce costs and increase accessibility by providing liquidity and eliminating the need for centralized authorities through distributed ledger technology. Innovations such as decentralized exchanges (DEXs), automated liquidity pools, and smart contracts are driving efficiency and inclusivity in financial services.

The implementation of blockchain in financial services is spreading quickly in a number of industries, including asset management, insurance, and lending and borrowing. DeFi solutions are being investigated by businesses, start-ups, and investors with the aim to improve financial processes, enhance transaction efficiency, and open up new revenue sources. DeFi has the potential to disrupt established financial models and open the door for a decentralized financial future as the blockchain ecosystem advances.

This blog looks at the latest developments in DeFi, the effects of blockchain on the financial services sector, and the challenges that companies must overcome to fully benefit from the technology. Financial companies, IT executives, software developers, and businesses wishing to understand and implement DeFi solutions for their business plans are the target audience.

The Core Technologies Powering DeFi

A variety of important blockchain technologies which enable safe, open, and effective financial transactions are driving the rapid growth of decentralized finance, or DeFi. These developments, which range from scalability solutions to smart contracts, are transforming the way financial services function within a decentralized ecosystem.

Decentralized Apps – Transforming Traditional Banking

Applications that use blockchain technology to deliver financial services without depending on centralized organizations are known as DApps. They allow users to carry out a number of tasks without first needing permission from banks or other centralized institutions, including decentralized trading, management of digital assets, and lending. The dominance of standard banking has been challenged by DeFi platforms like Uniswap, Aave, and Compound, which show how DApps can deliver seamless financial and banking services with enhanced transparency and worldwide accessibility.

Smart Contracts – Automating Transactions

Smart contracts are code-based agreements that execute autonomously on blockchain networks. By automatically applying terms and conditions, cutting down on operating expenses, and limiting human mistakes, they do away with the need for middlemen. Smart contracts in DeFi enable borrowing, lending, trading, and yield farming while guaranteeing that blockchain transactions are secure and automated. Solana, Ethereum, and Binance Smart Chain are just a few of the platforms that use smart contracts to support various DeFi applications.

Layer 2 Scaling Solutions – Improving Efficiency

High gas costs and sluggish transaction rates are two scalability issues that blockchain networks confront as DeFi adoption increases. In order to overcome these constraints, layer 2 scaling solutions – like rollups and sidechains – process transactions off-chain prior to settling them on the main blockchain for storage. By drastically increasing transaction throughput and decreasing congestion, technologies such as Zero-Knowledge (ZK) Rollups and Optimistic Rollups make DeFi platforms more effective and economical. These developments are essential for guaranteeing that DeFi can grow to meet the requirements of widespread adoption.

Using these key technologies, Decentralized Finance seeks to challenge established financial paradigms, providing more affordable and effective alternatives to outdated banking institutions.

Key Trends Shaping the Future of DeFi

The future of DeFi is being shaped by a number of new trends that will increase the security, intelligence, and connectivity of financial services. A decentralized financial ecosystem that is more effective and scalable is being made possible by advancements in AI, blockchain interoperability, and next-generation DeFi models.

Combining AI and ML in DeFi Applications

DeFi platforms are increasingly employing machine learning (ML) and artificial intelligence (AI) to enhance automation, risk assessment, and decision-making. Analytics driven by AI enhance smart contract security, identify fraudulent transactions, and maximize yield farming tactics. By analyzing user behavior and market patterns, machine learning systems can provide more individualized financial services and more accurate price projections. AI’s contribution to Decentralized Finance will only grow in importance as it develops further, boosting efficiency in financial markets.

Cross-Chain Interoperability and Multi-Chain Ecosystems

A significant obstacle in DeFi is the fragmentation of blockchain systems, where many protocols function independently. This problem is being addressed by cross-chain interoperability solutions, which facilitate smooth data exchange and transactions between several blockchains. DeFi’s reach is increased and liquidity of crypto assets is improved by using technologies including Polkadot, Cosmos, and cross-chain bridges that enable asset transfers and interactions between ecosystems. The emerging norm is multi-chain DeFi platforms, which give customers unrestricted access to a wide variety of monetary services across multiple blockchains.

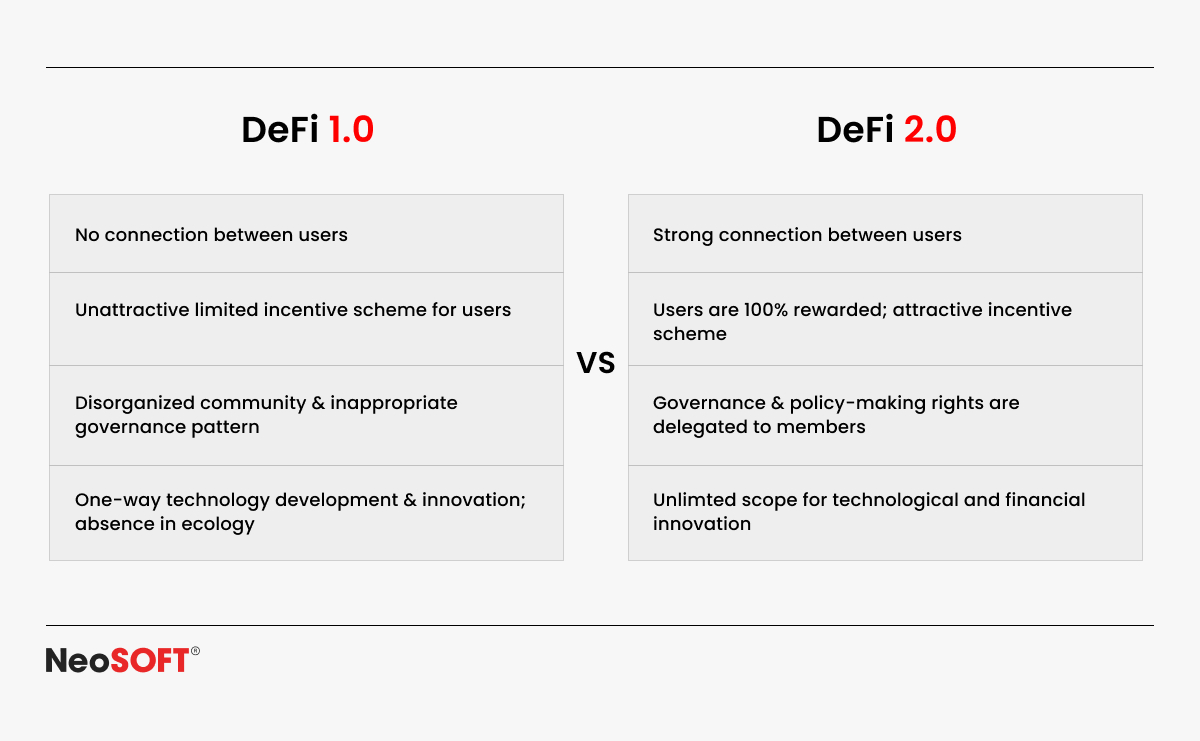

DeFi 2.0 – Enhancing Security, Liquidity, and Usability

A new movement called DeFi 2.0 aims to solve some of the issues with DeFi that were present in the original generation, including difficult user experiences, smart contract vulnerabilities, and liquidity inefficiencies. Self-repaying loans, decentralized insurance, and protocol-owned liquidity are examples of innovations that are lowering user risks and increasing capital efficiency. Additionally, enhancements in security features and user-friendly interfaces are opening up DeFi to a wider audience. DeFi 2.0 is about building a more robust and sustainable decentralized financial system, not merely about financial innovation.

Challenges and Risks in DeFi Adoption

DeFi is transforming finance services, but there are potential hazards associated and risks involved with its widespread use. To guarantee DeFi’s long-term growth in value and stability, concerns about scalability and regulatory uncertainties must be resolved.

Regulatory Concerns and Compliance Issues

A major obstacle to the implementation of DeFi is the absence of well-defined regulatory frameworks. Regulating decentralized financial platforms that function without the use of conventional middlemen is a challenge that governments, regulators, and financial authorities throughout the world are facing. Both DeFi developers and users have challenges due to Know Your Customer (KYC) regulations, taxation, and anti-money laundering (AML) compliance. Finding a balance between regulatory compliance and decentralization will be essential to DeFi’s ultimate assimilation into mainstream finance institutions.

Vulnerabilities in Smart Contracts

Smart contracts have certain drawbacks despite their many benefits. The Decentralized Finance space has seen large losses as a result of contract code flaws, reentrancy attacks, and hacks, including flash loan assaults. Since users are in charge of protecting their assets and funds from risk in the absence of a central authority, hackers find DeFi services to be appealing targets. Though risks continue to be a significant obstacle, the industry is tackling these problems with stringent smart contract audits, decentralized insurance options, and improved security procedures.

Transaction Cost and Scalability Issues

Blockchain networks experience congestion as DeFi popularity increases, which causes sluggish processing times and high gas prices, especially on Ethereum. This issue with scalability restricts accessibility and deters smaller investors from taking part in DeFi initiatives. Rollups and sidechains are two examples of Layer 2 solutions that are assisting in cost reduction and transaction throughput improvement; nevertheless, smooth scaling on all Decentralized Finance platforms is still a work in progress.

DeFi must overcome these obstacles in order to become more widely accepted and to compete with established banking systems. DeFi will grow more robust and reachable by a worldwide audience as protocols fortify, legislative clarity improves, and scaling solutions develop.

Opportunities for Enterprises and IT Solutions Companies

Secure and Scalable DeFi Platforms

Businesses can create strong DeFi platforms with improved security, scalability, and interoperability to enable smooth financial transactions. Companies can provide effective and affordable services by utilizing smart contracts and Layer 2 scaling solutions.

Blockchain-Based Financial Solutions

Financial applications powered by blockchain, such as asset management programs, payment gateways, and lending platforms, can be developed by IT service providers. These developments assist companies in lowering expenses, increasing transparency, and speeding up transactions.

Consulting and Compliance Services for DeFi Adoption

Organizations require direction on risk management and compliance due to changing requirements. IT specialists can help companies with integrating DeFi solutions into existing financial systems, navigating regulatory frameworks, and putting secure smart contracts into place.

What’s Next for DeFi Protocols

Technology developments, legislative changes, and DeFi’s merger with traditional banking will all influence the company’s future course. More institutional involvement, more security, and wider adoption are anticipated in the upcoming DeFi phase, which will bring decentralized banking services closer to the general public.

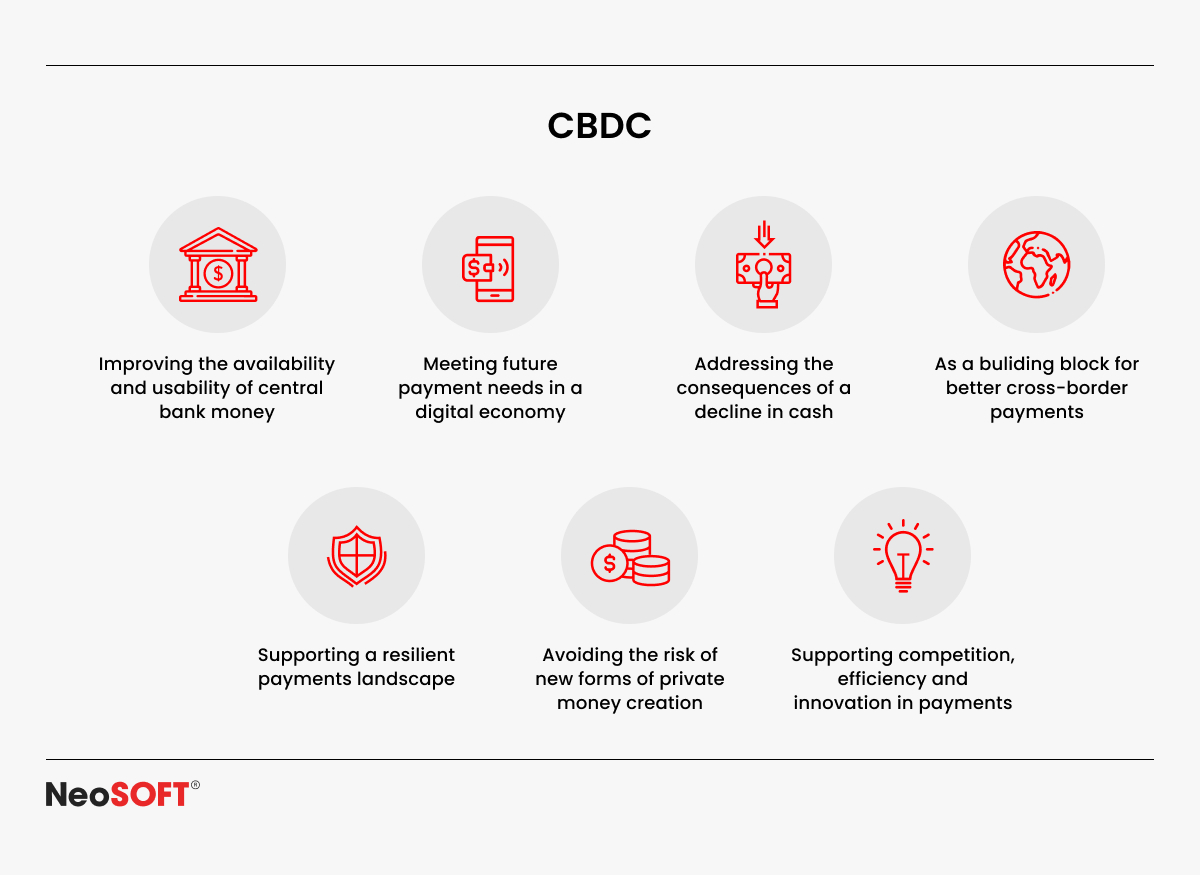

Central Bank Digital Currencies (CBDCs)

Central bank digital currencies, or CBDCs, are under consideration by governments and central banks around the world as a means of bridging the gap between blockchain-based systems and conventional banking. Despite the centralized character of CBDCs, their integration with DeFi may improve financial inclusion, liquidity, and regulatory compliance. Enabling programmable money via smart contracts and stablecoins backed by CBDCs will allow DeFi platforms to provide more regulated and safe financial products while preserving decentralization at its heart.

Decentralized Identity and Privacy Solutions

A major obstacle in DeFi is maintaining privacy while adhering to regulations. Decentralized identity (DID) and zero-knowledge proofs (ZKPs) are two innovations that are opening the door to private, safe transactions without compromising transparency. While upholding DeFi’s fundamental privacy concept, decentralized identification solutions will enable users to validate their credentials without disclosing private information, enabling KYC/AML compliance. With the development of privacy-focused technology, DeFi will become more secure and desirable to a wider spectrum of users.

With these developments, DeFi is well-positioned to further transform the financial industry by providing a more inclusive, transparent, and decentralized financial system. How well DeFi can work with current financial systems while upholding its core principles of accessibility and decentralization will be determined in the upcoming years.

Conclusion

Decentralized Finance is completely transforming the financial industry by eliminating intermediaries, boosting transparency, and improving access to financial services. Enabled by blockchain technology, DeFi is driving advancements in asset management, trading, lending, and payments, increasing the effectiveness and security of financial transactions. DeFi is positioned for significantly wider acceptance in financial markets in the upcoming years as trends like cross-chain interoperability, AI integration, and decentralized identity solutions go on developing.

Businesses have a rare chance to remain ahead of the curve by investing in blockchain and DeFi solutions. DeFi has the potential to revolutionize a number of businesses, whether it be through cost reduction, revenue model development, or the simplification of financial processes. But managing the intricacies and potential risks of DeFi – from security threats to regulatory compliance – calls for both knowledge and a calculated strategy.

As a software development and IT services company, we help businesses embrace the DeFi revolution by developing safe, scalable, and compliant blockchain solutions. Our expertise allows companies to fully utilize the potential of decentralized finance, from creating DeFi platforms and smart contracts to guaranteeing a smooth connection with existing systems. To find out how we can assist you in leveraging DeFi to innovate and open up new financial opportunities, get in touch with us today at info@neosofttech.com.